Generational attitudes towards investing are evolving, influenced by diverse experiences. While Baby Boomers benefited from a traditional model of wealth accumulation through stable careers and benign markets, subsequent generations (Gen X, Millennials, Gen Z) have experienced a series of global upheavals that have shaped their investment perspectives.

From record levels of student debt to turbulent job markets, younger generations face obstacles in securing financial stability. Moreover, there is scepticism among younger investors that traditional assets will provide the returns required for the lifestyles they want.

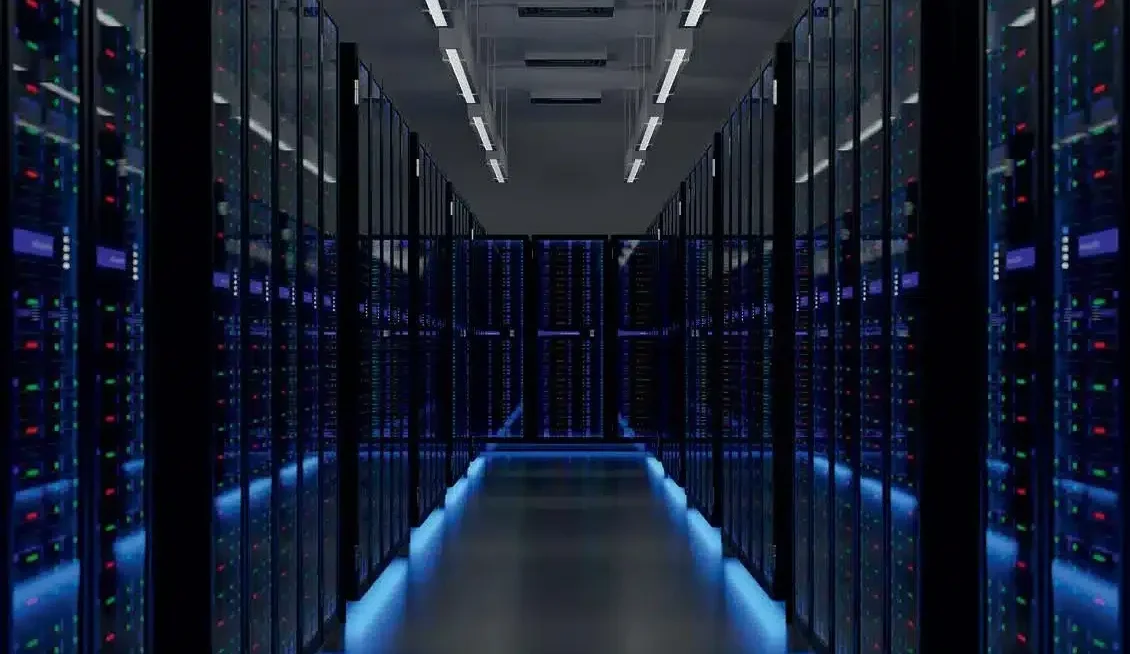

Enter neo-brokers, heralding a digital revolution in investing. These platforms offer personalized and inclusive investment experiences that resonate with younger investors. From low-friction onboarding to fractional exposure to private assets, neo-brokers leverage digital alternatives like cryptocurrencies and thematic ETFs to cater to the preferences of younger investors.

The rise of digital frontier assets, facilitated by advancements in blockchain technology, also present new opportunities for asset creation and portfolio diversification. The tokenization of assets, characterized by programmability and flexibility, blurs the lines between traditional and digital investments, offering unprecedented levels of customization and the ability to control assets from a digital wallet.

As we increasingly move to a digitised world, we believe the future of investing lies in personalized portfolios that align with individuals’ values, interests, and daily lives. Portfolios become more than just vehicles for future financial accumulation—they become integral to daily living, offering forms of utility and personal relevance.

We call this “better living through investing”, where digital alternatives and tailored investment strategies meet the diverse needs of different generations. As the financial landscape continues to evolve, the portfolio of the future holds the promise of personalized, impactful, and technologically driven investment experiences that appeal to all ages.